The Dow and U.S. stock market were stuck in neutral on Tuesday despite a blowout earnings report from Walmart, a sign that traders were treading more cautiously ahead of a slew of macroeconomic indicators later in the week.

Dow Struggles for Direction

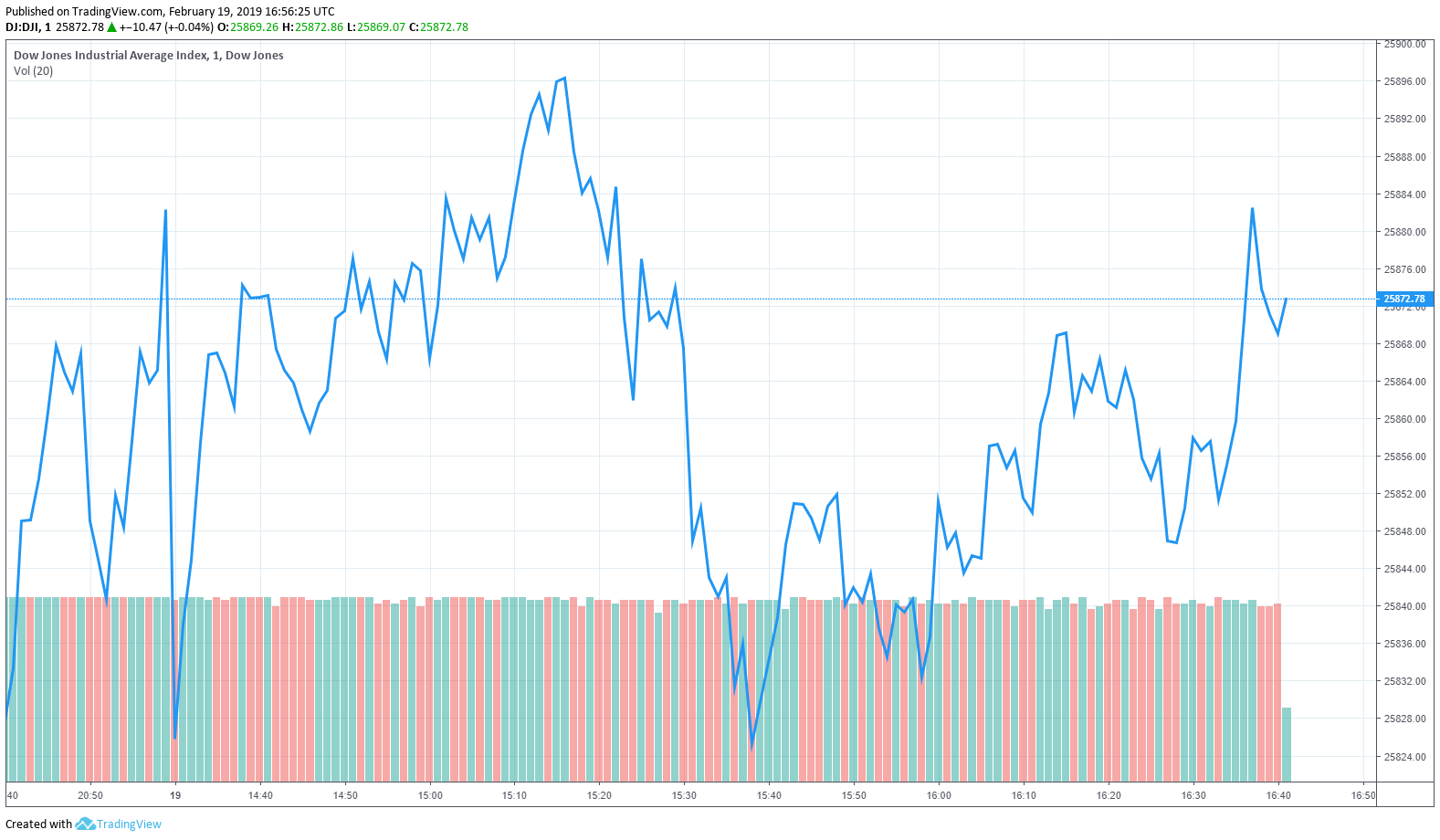

Wall Street’s benchmarks traded tepidly through the morning session, mirroring a relatively uneventful pre-market for Dow futures. The Dow Jones Industrial Average opened 34 points lower. It was last seen trading at 25,923.31, having gained 40 points, or 0.15%.

The broad S&P 500 Index nudged up 0.1% to 2,778.003, having erased an earlier drop. Six of 11 primary sectors reported gains, led by communication services and consumer stocks. On the opposite side of the spectrum, energy, financials, and industrials stocks provided much of the resistance.

The technology-focused Nasdaq Composite Index climbed 0.2% to 7,86.92.

A measure of implied volatility known as the CBOE VIX was last spotted making a modest move higher. VIX rose 1.7% to 15.17 on a scale of 1-100 where 20-25 represents the historical median range. The so-called “fear index” fell to more than four-month lows on Friday.

Get more insight from Hacked.com: Does this Chart Spell Doom for the S&P 500 Index?

Walmart’s Blowout Earnings Call

Shares of Walmart Stores Inc. (WMT) rose 3.7% on Tuesday after the retail giant posted stellar fourth-quarter earnings, underscoring its growing dominance in the e-commerce space.

The Bentonville, Arkansas-based company reported adjusted per-share earnings of $1.41, easily topping analysts’ estimate of $1.33. Revenues reached $133.79 billion compared with $138.65 billion expected.

E-commerce revenue surged 43% during the holiday quarter, prompting the retailer to maintain a strong sales outlook for fiscal 2020. CEO Doug McMillon said “a favorable economic environment” has helped Walmart take market share from its competitors.

Macro Data Flows

Appetite for risk was tepid on Tuesday as traders shifted their focus to the economic calendar. On Wednesday, the Federal Reserve will release the minutes of its most recent policy meeting, where officials unanimously agreed to hold off on raising interest rates. The official transcript may provide more rationale for the Fed’s increasingly dovish stance on monetary policy.

Markit is also teeing up a string of PMI releases covering Europe and the United States. Beginning on Wednesday, the research institute will report on manufacturing/services activity for Germany and the Eurozone. The U.S. reports are due the following day.

On Thursday, the Department of Commerce will issue its latest report on durable goods, a key proxy for manufacturing demand. During the same session, the National Association of Realtors (NAR) will report on existing home sales for January.

Separately on Thursday, the Labor Department will report on initial jobless claims for the week ended Jan. 17.

On Friday, four Fed speakers and European Central Bank President Mario Draghi will deliver speeches.

Featured image courtesy of Shutterstock. Chart via TradingView.