Shares of Southwest Airlines fell sharply on Wednesday after the low-cost carrier disclosed that the government shutdown which lasted for 35 days had a larger impact than previously thought.

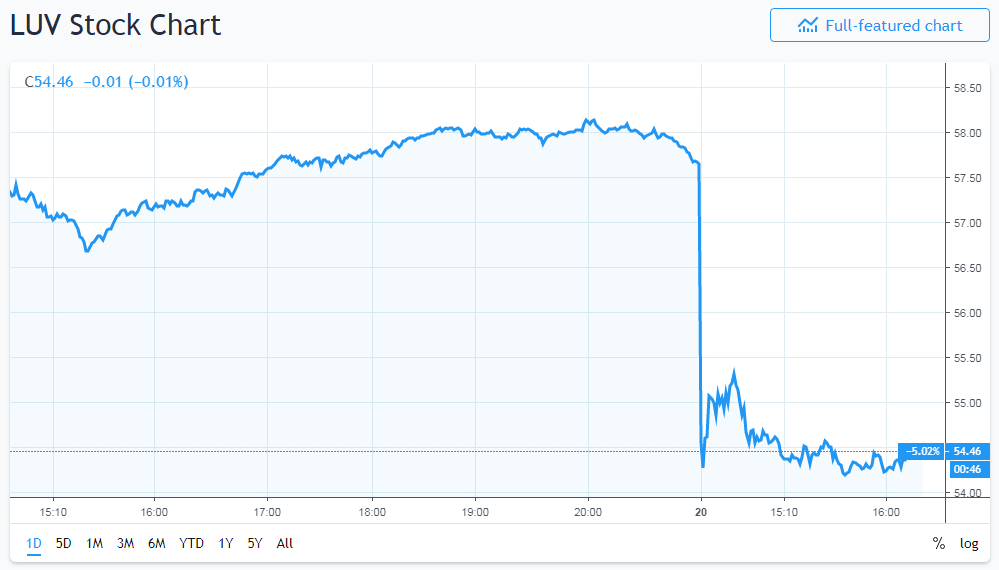

In a U.S. Securities and Exchange Commission filing, Southwest Airlines indicated that the estimated revenue impact of the shutdown had increased by up to six times. Shares of the low-cost carrier consequently fell by over 5% in early trading to below $55.

Southwest Airlines had Expected Negative Revenue Impact, Just not this Big

While reporting earnings last month the low-cost carrier had projected a drop in revenue of between $10 to $15 million. The discount carrier now sees the negative revenue impact of the shutdown rising to around $60 million:

The Company previously communicated an estimated negative revenue impact in the $10 million to $15 million range for January 1st through 23rd related to the government shutdown. Since then, the Company has continued to experience softness in passenger demand and bookings as a result of the government shutdown. As a result, the Company now estimates the negative revenue impact to first quarter 2019 to be approximately $60 million.

While shares of rivals such as United, Delta Airlines and American Airlines also fell, it was by much lower figures. According to Bloomberg, this is because the three are more diversified flying to more international routes compared to Southwest.

Hey Congress and Trump, Southwest Airlines’ CEO Thinks You’re a Disappointment

At the height of the U.S. government shutdown, the chairman and CEO of Southwest Airlines, Gary Kelly, expressed disappointment at the stalemate between the legislative and executive branches of government. Per the non-partisan Congressional Budget Office, the shutdown cost the U.S. economy $11 billion.

Just In: @USCBO says the #shutdown cost the US economy $11 billion — roughly double the cost of Trump’s proposed wall.

CBO calculates a $3 billion loss in Q4 2018 and $8 billion loss in Q1 2019. While some econ activity will come back, not all will…https://t.co/SUsOXJCeb9 pic.twitter.com/HZo7IBHbpI

— Heather Long (@byHeatherLong) January 28, 2019

Besides the loss of revenue, the shutdown disrupted the discount carrier’s plans, according to the Dallas Business Journal. Chief among these was a delay in beginning a flight service to the U.S. island state of Hawaii.

The carrier had been granted the requisite approvals by the Federal Aviation Administration by the time the shutdown started. However, there had been several validation processes which

Goldman Sachs Doesn’t Wait for Bad News to Sink in… Downgrades Southwest Airlines Stock

The low-cost carrier’s announcement of a larger-than-anticipated revenue drop due to the shutdown coincides with Goldman Sachs downgrading the stock. While lowering its rating from ‘neutral’ to ‘sell’ Goldman Sachs also revised earnings guidance downwards. Initially, the Wall Street firm was expecting earnings per share of $4.70 for fiscal 2019. Goldman Sachs now estimates it will be $4.45, per CNBC.

Part of the reason for the lowered estimates include the promotional costs the Hawaii service will incur upon launching. According to Catherine O’Brien, an analyst at Goldman Sachs, this will impact profits in the short term:

With the delay in Southwest’s ability to announce its Hawaii flights and begin selling tickets, we think the shortened selling window for its initial flights will create the need for the company to discount fares more heavily than we initially expected.