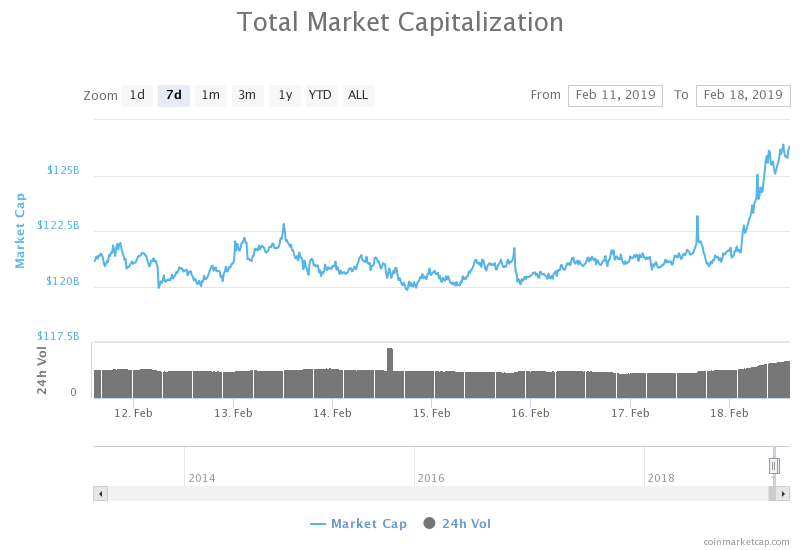

Cryptocurrency market started the week with an impressive rally, rising from $120.91 billion to as high as $126.391 billion in a day.

At 0900 UTC, the global crypto market cap was valued at 126.30, up 4.45% from Sunday’s low, with all the top 10 coins trending into their green territories. Bitcoin, the index’s leading cryptocurrency, posted 3.01% gains according to 24-hour adjusted timeframe calculated by TradingView.com. Ethereum, the second largest cryptocurrency, did better by surging 10% within the same time.

Bitcoin Cash, the Bitcoin-clone project led by Roger Ver, was the second-best performing cryptocurrency in the top ten. It rose more than 7% per the 24-hour adjusted timeframe. Stellar and XRP, within the same time, surged close to 2.80%. The Ethereum competitor EOS jumped more than 3.5%.

The least performing cryptocurrencies in the past 24 hours were Litecoin and Tron. While Charlie Lee’s brainchild rose by a modest 1.16%, the Justin Sun project’s native coin posted 0.08% profits.

US-China Trade War

The return of the crypto bulls coincides with positive developments in the global financial markets. With the trade talks between the US and China continuing this week in Washington, both the economies are looking to conclude the so-called “trade war” on a positive note. US President Donald Trump said that they would remove tariffs on China once if they come closer to having a “having a real trade deal” with Beijing.

Important meetings and calls on China Trade Deal, and more, today with my staff. Big progress being made on soooo many different fronts! Our Country has such fantastic potential for future growth and greatness on an even higher level!

— Donald J. Trump (@realDonaldTrump) February 17, 2019

The announcement followed with a soaring Asian market response. Mainland Chinese shares posted more significant gains on Monday, which also prompted stock markets in the region to advance. Stock markets in Japan, Australia, South Korea, and Singapore also closed Monday on a positive note.

So far today, the cryptocurrency market has displayed a strong intraday correlation with its Asian counterpart. The association would likely continue as the trend heads into the European session. According to CNBC analysts, the European market has opened to a mixed start. The resources stocks, which were exposed to China, led the gains. Nevertheless, the pan-European shares were flat during the early morning session.

Technicals: Bitcoin and Ethereum

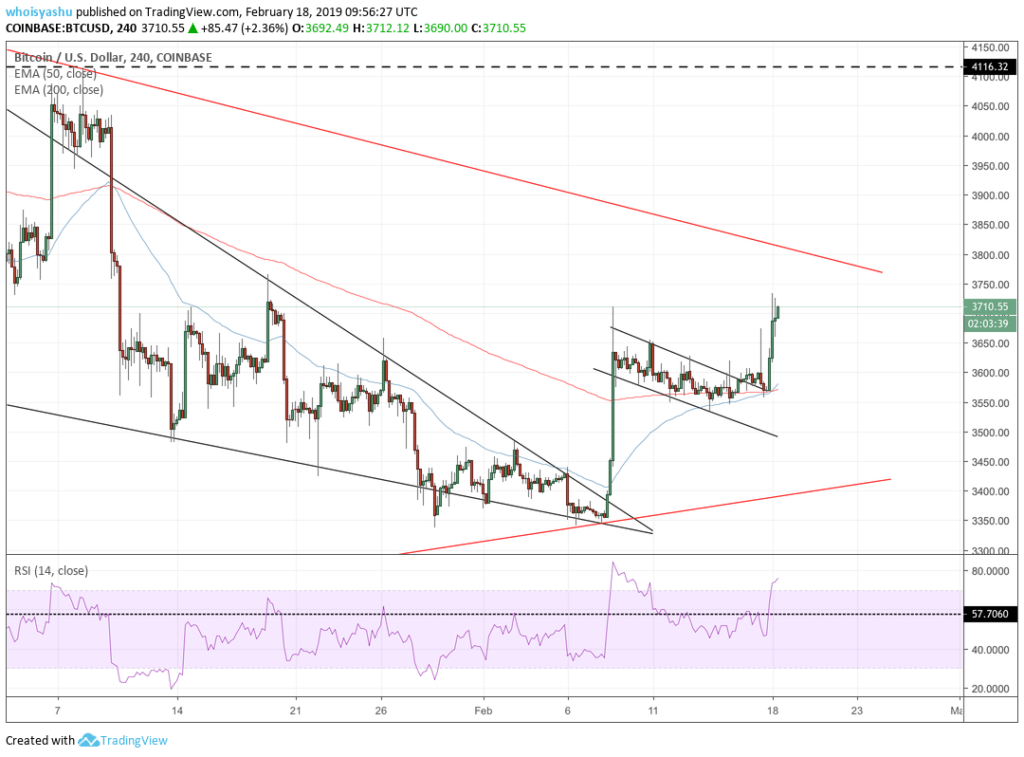

Looking at individual cryptocurrencies, Bitcoin has confirmed an uptrend after breaking out from what was a bull flag pattern all this time (we had also discussed a downside theory in this analysis). The BTC/USD rate is now looking to test a medium-term falling trendline (indicated in red in the chart below) for a potential rebound/breakout.

A slowdown in volume and volatility could indicate a potential downside action ahead of testing the red trendline above. In the event of a trend reversal, the BTC/USD rate could find support at 50-period moving average (indicated via the blue curve in the chart above).

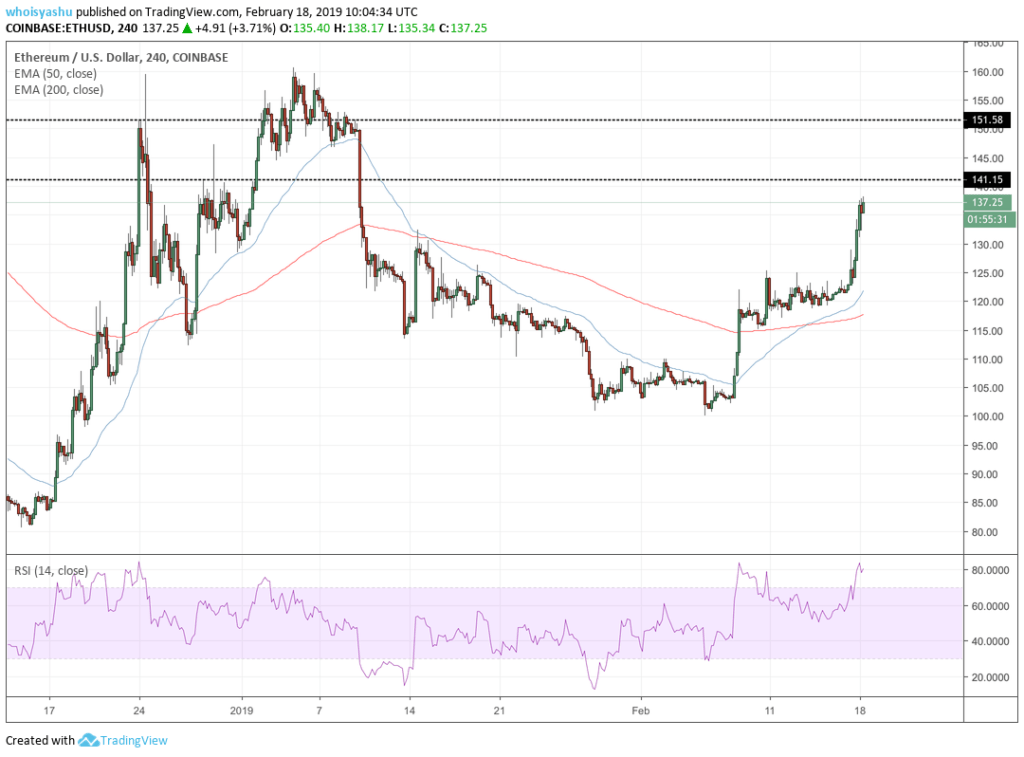

As for Ethereum, the best performing asset among the top ten coins, a potential deflection is possible in the area defined by $141-151.

Ethereum was the best performing major-cap currency against the dollar. 4H CHART | SOURCE: COINBASE, TRADINGVIEW.COM

At the same time, the cryptocurrency has support in its 50-period moving average (the blue curve). The curve in recent weeks has acted as resistance during the downtrends and support during the uptrends. Therefore, breaking below it would confirm a big downside move.

Click here for a real-time ethereum price chart and here for a bitcoin price chart.

Featured Image from Shutterstock. Price Charts from TradingView.