As Nobel Prize-winning economist Robert Shiller put it, “Bitcoin is a social phenomenon.”

Rumors, fear, and hype all play an enormous role in influencing the price of cryptocurrency, but these things are not so easy to identify on a chart. While many institutional traders use technical analysis to gain insights into price action, to ignore the emotional state of the market is to ignore a huge aspect of what defines it.

Those who truly understand how the market ‘feels’ have a huge advantage over competing traders and institutions – so how can such a thing be measured?

Acknowledging the influence of psychology and emotions in the market is one thing, but the key is being able to measure it and use it to create an actionable, data-driven trading strategy – doing this is called sentiment analysis.

Over the last ten years, interest in sentiment analysis has grown drastically, as shown in the Google Trends chart below.

Quantitative Sentiment Analysis

In a way, it seems quite straightforward to gain some sort of basic insight into the public sentiment of a single company or cryptocurrency project. For example, if certain influencers paint an overwhelmingly negative picture of Bitcoin on a given day, it’s likely that the public sentiment will have a negative trend.

This, of course, is due to the well-documented phenomenon of crowd psychology which a recent survey indicates plays a strong role in the price of Bitcoin.

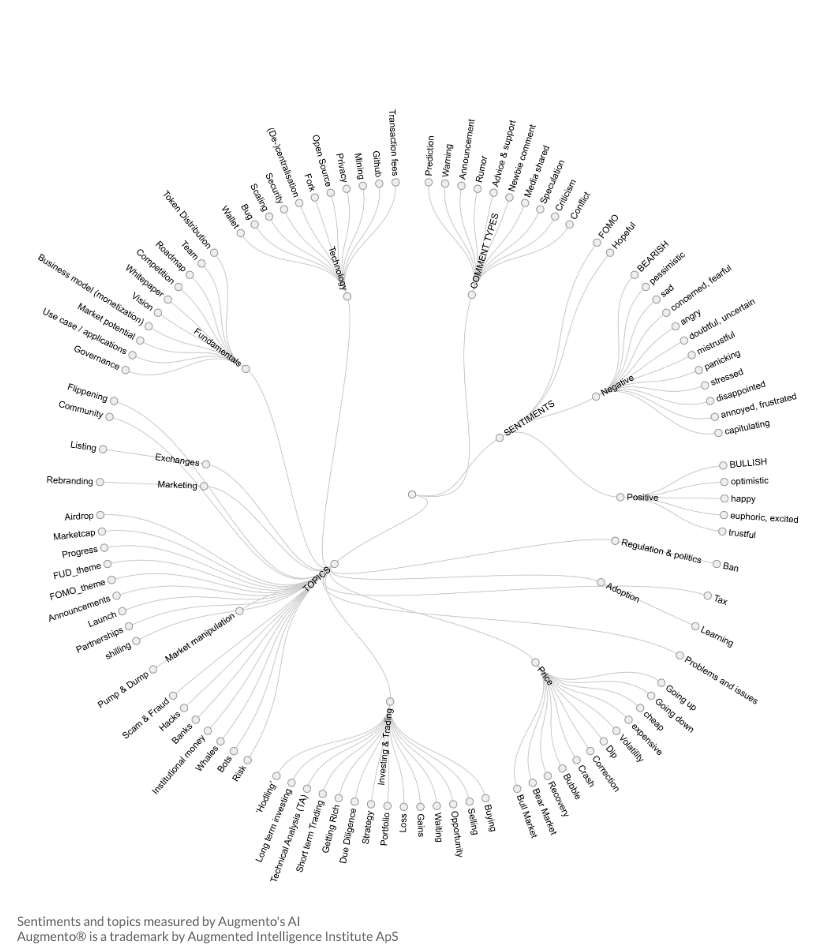

The answer to measuring and predicting this phenomenon with relevant data points lies in analyzing vast swathes of social media updates on platforms like Twitter and Telegram as well as the news headlines and forum comments sections. Unlike reading the daily news on Bitcoin, this can’t be done efficiently by a single person – this is a job that only artificial intelligence can handle.

The recent fusion of AI and social media data can give hedge funds the data required to gain real insight into the emotional state of the cryptocurrency community as a whole along with communities for individual projects.

Crypto Hedge Fund Darwinism: Survival of the Fittest

A recent report by crypto research and fintech analysis firm Autonomous Research LLC showed that as of August 2018, most crypto hedge funds were down 50% for the year, with many funds shutting down. As the bear market continues and panic sets in for many retail investors, irrational emotions play an even stronger role in the price action which makes understanding market sentiment all the more important, helping to reduce risk.

The ongoing “crypto winter” is creating arguably the toughest conditions for crypto hedge funds to date. Only the strong will survive, and part of that strength lies in adaptability.

Hedge funds need to take a lean, cautious approach towards low-risk investments with a high chance of a good ROI, and part of identifying low-risk investments lies in tapping into the crowd psychology at play among retail investors.

Yale economists recently published a study which found that cryptocurrencies behave differently from other asset classes, but could be predicted by monitoring investor attention. According to the Ivy League economists, cryptocurrency price movement is tightly correlated with the number social media mentions it receives on Google, Twitter, etc., with prices surging as abnormally high mentions occur.

Sentiments and Topics Moving the Crypto Market

Sentiment analysis is used to greatly augment existing trading strategies, based on, for example, technical indicators or price action. Here sentiment analysis provides alternative signals, which are especially relevant for intangible assets.

Human traders make rash emotional decisions. Using technology, we can monitor how sentiments and trends drive investment decision, and use that to inform trading strategy.

By scientifically analyzing the reaction of the cryptocurrency community as a whole, analysts can now finally place an ear to the beating heart of the cryptocurrency market and transform opinion into data.

About the Author: Michael Baumgartner is the CEO of Augmento, an AI firm offering proprietary software that can grasp market-driving emotion and topics of discussions within milliseconds, giving hedge funds a vital competitive edge in the fast-paced crypto markets.

Featured Image from Shutterstock